How to Swap Bitcoin to Stablecoins Without KYC (Updated 2025)

Introduction: Converting Bitcoin (BTC) into stablecoins like USDT or USDC is a common move for crypto users – whether to lock in profits, reduce volatility, or use those dollar-pegged tokens in DeFi or everyday transactions. Traditionally, doing a Bitcoin-to-stablecoin swap meant using a big centralized exchange (think Binance or Coinbase) and dealing with tedious KYC (Know Your Customer) verification. But today, more people are looking for a private, hassle-free way to make this swap without KYC. High-profile exchange failures (like FTX’s collapse) and withdrawal freezes have only strengthened the desire for alternatives. The good news is that decentralized methods now make it possible to swap BTC to stablecoins safely, quickly, and without handing over your identity. In this guide, we’ll explain why users want to swap BTC to stablecoins without KYC, the problems with the old way of doing it, and how TeleSwap offers a better solution. We’ll also provide a simple step-by-step tutorial for using TeleSwap to convert your Bitcoin into stablecoins, and answer frequently asked questions along the way.

Why Swap Bitcoin to Stablecoins (Without KYC)?

Swapping Bitcoin into stablecoins like USDT (Tether) or USDC (USD Coin) is popular for a few key reasons:

- Hedge Against Volatility: Bitcoin’s price can swing wildly. Converting some BTC into a stablecoin (pegged 1:1 to USD) lets you preserve value when you expect volatility. For example, if BTC’s price is high and you want to secure that value, swapping to USDT/USDC locks in your gains in a dollar-equivalent token.

- Utilize Stablecoins for Transactions: Stablecoins are widely used for trading, lending, or even making purchases, because their value is steady. It’s easier to plan finances with a token worth $1 than with BTC’s constantly changing price. By swapping into stablecoins, you can participate in DeFi platforms (yield farming, lending, etc.) or send money to someone without worrying about exchange rate fluctuations.

- Avoiding Banks or Fiat Off-ramps: If you want to “cash out” some Bitcoin value without going through a bank or traditional currency, stablecoins provide a crypto-native way to hold USD value. You can later swap those stablecoins for fiat or other assets as needed.

- Privacy and Accessibility: Doing this swap without KYC is appealing if you value privacy or live in a region where accessing big exchanges is difficult. KYC involves providing personal identification (passport, driver’s license, etc.) to an exchange. Not everyone is comfortable sharing that data due to privacy concerns, and some people (in restricted countries or without documents) can’t complete KYC at all. A no-KYC method means you retain more anonymity and no bureaucratic hurdles.

In short, many Bitcoin holders – especially those who care about privacy – want to move into stablecoins quickly and quietly. Next, let’s look at why the traditional route (centralized exchanges) isn’t ideal for this purpose.

The Traditional Route via Exchanges (and Its Drawbacks)

Up until recently, the typical way to swap BTC for stablecoins was to use a centralized exchange (CEX) like Binance, Coinbase, or Kraken. While these platforms provide a familiar interface, they come with several drawbacks that can frustrate users:

- Mandatory KYC and Account Setup: Centralized exchanges require you to create an account and verify your identity before you can trade. That means sending personal documents and waiting (sometimes days) for approval. It’s inconvenient and erodes your privacy – you’re trusting the platform with sensitive data.

- Custodial Control (Not Your Keys): When you deposit your Bitcoin into an exchange, you give up custody of those coins. The exchange holds your BTC in their wallet until you trade and withdraw. During that time, you’re trusting the platform to keep your funds safe. History has shown this trust can be misplaced (exchange hacks, freezes, or even insolvency can put your assets at risk). As one guide put it, on a CEX “you lose custody… you lose privacy… you lose flexibility… and you accept risk”. This is the opposite of Bitcoin’s core principle: “Not your keys, not your coins.”

- Withdrawal Delays and Limits: Converting on an exchange isn’t instant. You might wait for your BTC deposit to get enough confirmations, then after trading to a stablecoin, wait again for the exchange to process your withdrawal. Exchanges often have scheduled batch withdrawals or security holds, so getting your USDT/USDC out can take hours or even longer. Some impose daily withdrawal limits, which is a headache if you want to swap a large amount.

- Fees at Multiple Steps: Using a CEX can rack up fees – you may pay a deposit fee (or miner fee for sending BTC in), a trading fee for the BTC/USDT trade, and a withdrawal fee to send the stablecoins out. These fees add up. By contrast, a direct wallet-to-wallet swap method can be more cost-efficient (we’ll cover TeleSwap’s low fees later).

- Geographical Restrictions and Bans: Centralized platforms must comply with regulations. They might block users from certain countries or regions, and they can freeze accounts if regulations change. If you’re in a country not supported by major exchanges, doing a KYC-verified swap might not even be possible. Even if you are, you’re at the mercy of the exchange’s policies which can change overnight.

- Trust and Single Point of Failure: Finally, there’s the fundamental issue of trust. When using a CEX, you trust that company with both your identity and your coins. Exchanges can suffer downtime, get hacked, or even go bankrupt (as seen with Mt. Gox in the past and more recently the collapse of FTX). Users have experienced sudden withdrawal freezes and loss of funds in such events. As one crypto commentator noted, this isn’t what crypto was meant to be. Bitcoin was designed to be peer-to-peer, without relying on a central intermediary.

Bottom line: While centralized exchanges work, they’re far from ideal for swapping BTC to stablecoins if you value speed, security, and privacy. You end up jumping through hoops – verifying your identity, trusting the exchange to not lose/steal your funds, and waiting for their processes. It’s no wonder users are seeking alternative ways to swap BTC that keep them in control.

Decentralized Swaps – A Better Alternative

Thankfully, the crypto landscape is changing. We now have decentralized swap solutions that let you convert Bitcoin to other assets (like stablecoins) without a middleman. These methods avoid the downsides of CEXs by leveraging blockchain technology – you trade directly from your wallet, and the trade is executed by smart contracts or peer-to-peer protocols. There’s no need to create an account, no KYC, and you remain in control of your coins throughout the process.

Several approaches have emerged over the years:

- Peer-to-Peer (P2P) Marketplaces: Platforms like Bisq, HodlHodl, or LocalCoinSwap connect individual buyers and sellers of Bitcoin. You could find someone willing to trade your BTC for their USDT and trade directly. These are non-custodial and usually don’t require KYC, but they can be slow and require finding a counterparty. You might have to wade through offers and escrow processes to ensure no one cheats. Prices can also be less favorable on P2P markets due to lower liquidity. P2P trading is a solid option for privacy, but it’s not “instant” or newbie-friendly in many cases (you need to navigate the marketplace and perhaps negotiate or wait).

- Atomic Swaps & HTLCs: Atomic swaps are a clever technology that allows two parties to swap assets across blockchains directly, using cryptographic guarantees (either both sides complete or nothing happens, preventing fraud). In theory, you and someone else (or a service) could perform an atomic swap where you send BTC and receive USDT on another chain in one atomic transaction. However, classic atomic swaps are quite technical and often slow or limited. They usually require specialized wallet support and coordination between parties. This approach has mostly been experimental or used by advanced users; it’s not a simple click-and-swap for the average Bitcoiner.

- Wrapped Bitcoin on DeFi Exchanges: Another indirect method is to wrap your BTC into an ERC-20 token like WBTC or renBTC and then trade it on a decentralized exchange (DEX) for a stablecoin. For example, you’d lock BTC with a custodian or protocol to get WBTC on Ethereum, then use Uniswap to swap WBTC for USDC. While this taps into the DeFi ecosystem, it’s a multi-step process and involves trust in the wrapping custodian (WBTC, for instance, is managed by a consortium that holds the BTC reserves). You also have to pay fees on two chains and deal with wrapping/unwrapping. In the end, you’ve effectively used a centralized custodian to handle the BTC, which might require KYC or at least isn’t fully decentralized. It works, but it’s not elegant or completely trustless.

Each of these methods has trade-offs. P2P can be private but not instant; atomic swaps are trustless but user-unfriendly; wrapping BTC for DeFi regains some control but introduces new custodians to trust. What users really want is the best of all worlds – a method to swap BTC to stablecoins that is easy (like a CEX), fast, and also non-custodial with no KYC.

This is where TeleSwap comes into play, combining ease-of-use with true decentralization. Let’s introduce TeleSwap and see how it makes swapping Bitcoin to stablecoins without KYC both simple and secure.

Introducing TeleSwap – Swap BTC for Stablecoins with No KYC, No Custody

TeleSwap is a new decentralized platform that offers one of the easiest ways to swap Bitcoin for assets on other chains – including popular stablecoins – without using a centralized exchange. In fact, TeleSwap was designed to be a “Bitcoin bridge” that connects Bitcoin to various blockchains in a trustless way. It allows you to trade your BTC for tokens like USDT or USDC on networks such as Ethereum, Polygon, Arbitrum, BNB Chain, all directly from your own wallet.

Here are the key features that make TeleSwap stand out:

- No KYC or Registration: You don’t create an account on TeleSwap. There’s no sign-up form and no identity verification process at all. Using TeleSwap is as simple as visiting a web app and connecting your wallet. In other words, “No KYC. No account. You only interact with smart contracts. The platform itself never learns who you are – it just sees blockchain transactions.

- Self-Custody (You Hold the Keys): TeleSwap is non-custodial and trustless. You never have to deposit your coins into a company’s wallet. Instead, you initiate the swap directly from your Bitcoin wallet, and the protocol handles the exchange. Your BTC stays in your control until the moment it’s swapped for the target asset, and the stablecoins you receive go straight to your own wallet. This means you maintain custody at all times – there’s no point where TeleSwap can freeze or mismanage your funds. It’s effectively peer-to-protocol trading, enforced by code.

- No Wrapped BTC Requirement: Unlike some cross-chain solutions, TeleSwap does not force you to use a wrapped Bitcoin token as the final output. You’re dealing with native assets on each side – real BTC on the Bitcoin network and real USDT/USDC on the target chain. Under the hood, TeleSwap’s smart contracts may use a temporary wrapped representation to facilitate the swap, but you as the user don’t have to handle or manage a wrapped token yourself. For example, if you’re swapping BTC to USDC on Ethereum, you send in native BTC and receive native USDC in your Ethereum wallet. This is a big deal – it simplifies the process and eliminates the need to trust a third-party custodian for wrapping. It’s essentially a direct BTC-to-ERC20 conversion in one step.

- Fast Swaps: TeleSwap is optimized for speed. In many cases, a swap can complete in just a few minutes. For instance, swapping BTC to USDC on a fast chain like Polygon can happen in under a minute in ideal conditions! (Swapping involving the Bitcoin network typically waits for at least 1-2 confirmations on Bitcoin for security, which is about 10–20 minutes – still relatively quick and much faster than withdrawing from some exchanges). The bottom line is there’s no lengthy wait for manual processing; once your transaction confirms, the protocol delivers your funds automatically.

- Low Fees: Because it’s on-chain, TeleSwap charges minimal fees. There is no hefty trading fee or withdrawal fee as with exchanges. Typically, you’ll pay a small network fee and a tiny protocol fee. According to TeleSwap’s documentation, the fee to the node operator (called a Locker node) is only 0.1% of the amount, plus the necessary network fees to perform the swap on-chain.. For perspective, 0.1% is likely much lower than what you’d lose to exchange spreads and withdrawal fees on a CEX. And because the swap is direct, you’re not double-paying fees on two different networks; TeleSwap’s system cleverly handles fees so you pay once for the whole operation.

- Multi-Chain Support: TeleSwap connects Bitcoin to multiple blockchain ecosystems. You can swap BTC into assets on Ethereum, Polygon, Arbitrum, BNB Smart Chain, Base, and even The Open Network (TON), with more networks likely to be supported over time. This means you have flexibility in what form of stablecoin you receive – it could be USDT on Ethereum, USDC on Polygon, BUSD on BNB Chain, etc., depending on your needs. TeleSwap basically bridges the liquidity between Bitcoin and these networks. For example, you could swap BTC for USDT on Polygon to benefit from low transaction fees and then use that USDT in Polygon’s DeFi apps. Or swap BTC for USDC on Ethereum if you plan to use the funds on the Ethereum mainnet. TeleSwap’s reach across chains makes it a one-stop solution for moving BTC value anywhere in the crypto ecosystem.

- Simple User Experience: Despite the complex cross-chain mechanics under the hood, TeleSwap is designed to be user-friendly. You don’t have to manually juggle two or three transactions; it’s essentially a one-click swap after setup. The interface is straightforward: choose what you’re swapping from and to, input the amount, and follow the prompts. There’s no need to learn about Bitcoin hash time-locked contracts or any technical wizardry – TeleSwap handles all that. In short, it feels a lot like using any typical swap or exchange app, but without accounts or middlemen.

- Highly Secure and Decentralized: For those wondering “Can I trust this protocol?” – TeleSwap’s architecture is fully decentralized and secured by the blockchain itself. It utilizes a Bitcoin light client on the target chains to verify Bitcoin transactions, meaning the Ethereum-side smart contract (for example) actually checks Bitcoin’s blockchain proofs to confirm BTC deposits, rather than trusting a single server. TeleSwap also employs a network of decentralized nodes (Lockers and Teleporters) that facilitate transfers. These nodes have to put up collateral and will be slashed (penalized) if they misbehave or fail to execute swaps properly. This economic design keeps them honest. In essence, TeleSwap achieves “Bitcoin-grade” security for your swap – it’s as secure as making a normal Bitcoin transaction since everything is validated on-chain. No one at TeleSwap can censor or stop your swap; it’s permissionless. And because it’s open-source, it has undergone security audits and is open for the community to inspect. This decentralized, trust-minimized approach is exactly what many Bitcoin users have been waiting for.

To sum it up, TeleSwap provides a trustless bridge and exchange rolled into one. It lets you swap BTC to stablecoins (or vice versa) with no KYC, no custodial risk, and no hassle. Your Bitcoin goes in, and your USDT/USDC comes out – simple as that. Now, let’s walk through how you would actually use TeleSwap step by step, so you can see how easy it is.

Step-by-Step Guide: Swapping Bitcoin to USDT/USDC Using TeleSwap

Ready to swap your Bitcoin for stablecoins without an exchange? Follow these steps to use TeleSwap safely. Even if you’re a beginner, you’ll find the process straightforward:

1. Set Up Your Wallets: Since this is a cross-chain swap, you will need two things:

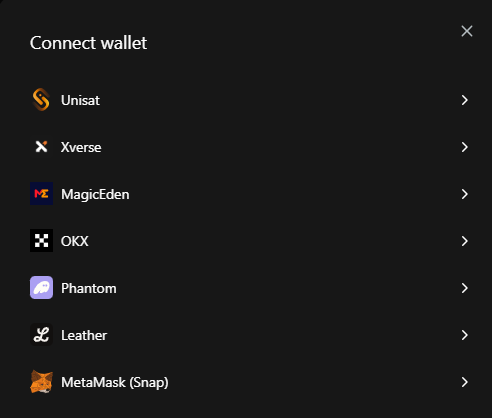

- A Bitcoin wallet that holds the BTC you want to swap. This can be any standard Bitcoin wallet where you control the private keys (for example, a mobile wallet like Unisat, Xverse, MagicEden OKX, Phantom and Leather or a hardware wallet like Ledger). Make sure you have access to send BTC from this wallet.

- An Ethereum-compatible wallet for the stablecoins on the destination chain. The easiest choice is MetaMask (which works for Ethereum, Arbitrum, Polygon, BSC, etc.), but you could also use alternatives like Trust Wallet or Coinbase Wallet. You’ll receive your USDT/USDC into this wallet. Ensure this wallet is installed and that you have it ready in your browser (or device) for connection. You’ll also need a tiny bit of the destination chain’s native token to pay transaction fees (for example, a bit of ETH if you’re receiving stablecoins on Ethereum, or MATIC if on Polygon).

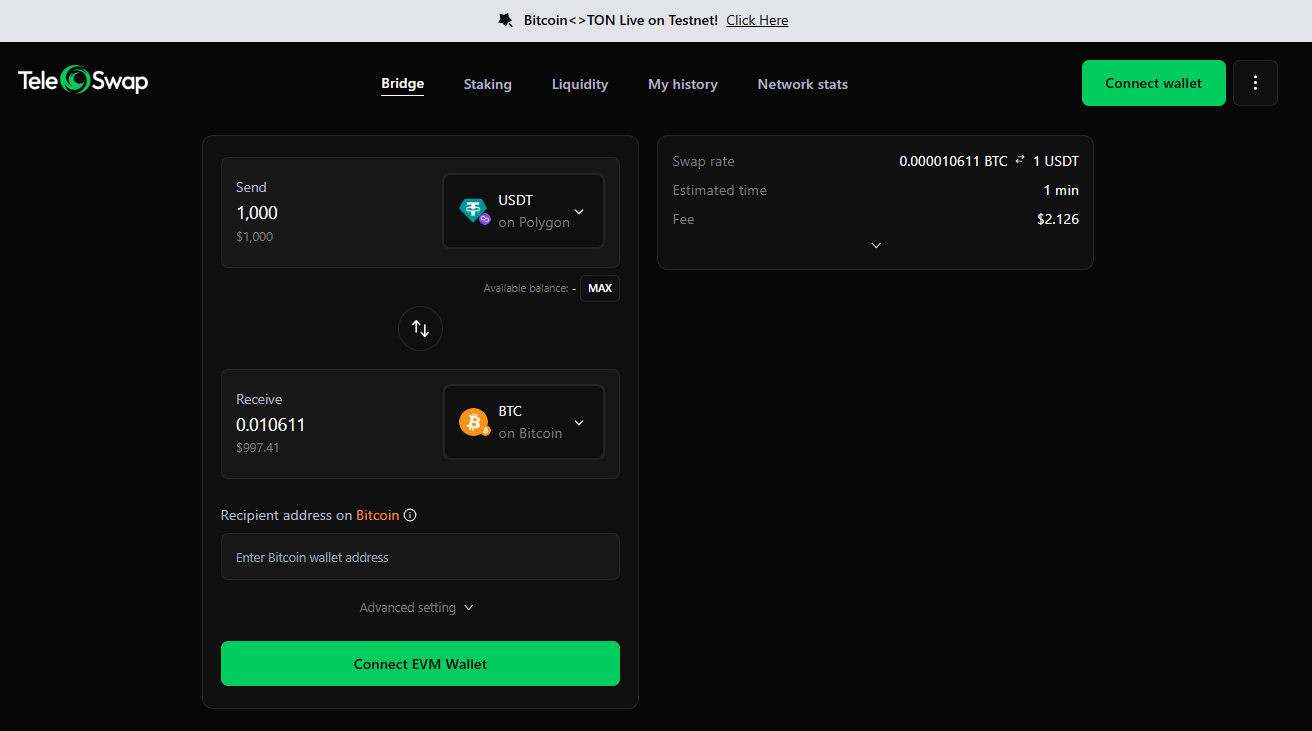

2. Go to the TeleSwap App: Open your web browser and navigate to app.teleswap.xyz, which is the official TeleSwap web application. You should see an interface that allows you to select tokens for swapping. Connect your Ethereum-compatible wallet to the app when prompted (for example, if you have MetaMask, it will ask to connect). No login or registration is needed – the dApp just links to your wallet. Tip: Ensure you are on the correct official site (double-check the URL) to avoid any phishing sites.

3. Choose “Bitcoin” as the Asset to Swap From: In the TeleSwap interface, you’ll usually have two dropdown menus or panels – one for the asset you send, and one for the asset you receive. On the “You Send” side, select BTC (Bitcoin) and the Bitcoin network. This indicates you will be sending Bitcoin in the swap. On the “You Receive” side, select the stablecoin you want – for example USDT or USDC – and choose the target network (Ethereum, Polygon, Arbitrum, etc. depending on where you want your stablecoins). TeleSwap currently supports major stablecoins on popular networks, so pick what suits you. For instance: “You Send: BTC on Bitcoin”, “You Receive: USDC on Ethereum” (if you want USDC on Ethereum mainnet), or “You Receive: USDT on Polygon” for a fast, low-fee outcome on Polygon.

4. Enter the Amount of BTC to Swap: Input how much Bitcoin you want to swap. The interface will typically show you an estimate of how much stablecoin you’ll get in return, after fees, based on current rates. TeleSwap finds the best rate by swapping through its liquidity pools or integrated DEXs under the hood. Make sure you’re okay with the rate and minimum output shown. (If the slippage is too high, you can adjust or try a smaller amount. Usually, TeleSwap has good liquidity for common pairs, so this shouldn’t be an issue for reasonable trade sizes.)

5. Provide Your Receiving Address (if needed): Since you connected an EVM wallet, TeleSwap knows where to send the stablecoins (it will send to your connected wallet address on the chosen chain). However, for the Bitcoin side, the app needs to tell you where to send your BTC. After confirming the details, TeleSwap will generate a Bitcoin deposit address for your swap. This is a unique address tied to your swap request. It will be displayed for you, along with the exact amount of BTC you should send (if you didn’t already specify an exact amount, it will expect whatever you input). Copy the Bitcoin address shown (or scan the QR code if you’re on mobile and your BTC wallet is on another device).

6. Send BTC to the Provided Address: Now, open your Bitcoin wallet and initiate a transaction, sending the exact amount of BTC you decided to swap to the TeleSwap provided address. Think of this like depositing into an exchange, except it’s a decentralized address controlled by the TeleSwap protocol’s smart contract system. Double-check the address and amount before sending – if you send the wrong amount, the swap might not execute, and if you send to the wrong address, that BTC could be lost forever (the system won’t know it’s you if it’s the wrong address). There’s no memo or special data needed, just a plain BTC send to that address. Once you broadcast the Bitcoin transaction, TeleSwap’s network of nodes will detect it. Your BTC remains in your control until this point – you are effectively signing a transaction to move it now.

7. Wait for Confirmation: The Bitcoin network will need to confirm your transaction. TeleSwap, for security, waits for a couple of confirmations (typically 2 confirmations for BTC->EVM swaps) before considering the BTC deposit final. This usually takes around 10–20 minutes (each Bitcoin block is ~10 min on average). While you wait, you can typically watch the status on the TeleSwap interface – it might show “Waiting for BTC deposit” or similar. You can also track your Bitcoin transaction via any block explorer to see when it gets the required confirmations.

8. Swap Execution: Once your BTC transaction is sufficiently confirmed, the magic happens automatically. TeleSwap’s protocol will lock in that BTC with its decentralized custodian nodes and simultaneously execute a trade on the target chain to get your stablecoins. In our example of BTC->USDC on Ethereum, TeleSwap will mint an equivalent amount of a wrapped BTC token on Ethereum (representing your BTC) and immediately trade that for USDC using a decentralized exchange (this all happens behind the scenes in one transaction). Because you set the swap up with a minimum expected amount, if for some reason the rate moved drastically against you, TeleSwap would detect it and fail gracefully (returning a wrapped BTC to you rather than a bad deal). But assuming normal conditions, it will successfully convert your BTC to the chosen stablecoin.

9. Receive Your Stablecoins: The final step: TeleSwap will send the output stablecoins to your connected wallet on the destination chain. You will see the USDT/USDC (or whichever token you chose) arrive in your wallet. This is an on-chain transfer, so it’s transparent and verifiable. At this point, the swap is complete! You now hold the stablecoins, and the TeleSwap contract/network has the BTC which it will manage on the backend. The entire process required no trust in a central exchange – it was all driven by smart contracts and the TeleSwap node network.

10. (Optional) Verify and Use Funds: It’s always good practice to verify you received the correct amount. Check your wallet balance or view the transaction on a block explorer for the destination chain. You should see that the source of the stablecoins is the TeleSwap smart contract address. Now you’re free to use your stablecoins however you want – hold them, send them, invest in DeFi, or convert to fiat via another route. You achieved the swap without any exchange accounts or KYC forms!

That’s it. In summary, you went to a dApp, chose BTC -> stablecoin, sent BTC from your wallet to a given address, and got stablecoins delivered to your other wallet. The interface is intuitive and you don’t need deep technical knowledge to follow these steps. Many users report that the whole swap can be done in just a few minutes once the Bitcoin transaction is confirmed. Compared to the hours or days it might take using a CEX (account setup, approval, deposit wait, trade, withdrawal wait), TeleSwap feels almost instant.

Real-world example: TeleSwap’s team demonstrated swapping BTC to USDC on Polygon in under one minute. Times can vary, but it showcases how efficient this is. Now that you know how it works, let’s address some common questions you might have about safety, wallets, and support.

FAQ: Swapping Bitcoin to Stablecoins Without KYC

Q: Is it safe to swap Bitcoin without KYC using TeleSwap? A: Yes – when done through a trustless protocol like TeleSwap, it’s very safe. TeleSwap is fully decentralized and built with security in mind. There’s no central exchange holding your funds; instead, the process is governed by smart contracts and a network of nodes with strong economic incentives to be honest. In fact, TeleSwap’s security model is comparable to Bitcoin’s own security. It uses a Bitcoin light client on the target chain to verify every BTC deposit and a slashing mechanism to punish any node that misbehaves, giving it “Bitcoin-grade security” There is no single point of failure and no one can intercept your swap or steal your info – no KYC means you remain pseudonymous. That said, you should take standard precautions: only use the official TeleSwap app/website, keep your wallet secure, and double-check addresses you input. If you do those, you’re effectively just doing normal blockchain transactions, which are very safe. No KYC doesn’t mean shady – it means you’re using open protocols available to anyone. TeleSwap has also been audited and tested during its testnet phase, and now it’s live on mainnet with backing from reputable industry players. So in summary, swapping without KYC can be just as safe as using a big exchange – and arguably safer, since you’re not trusting a company with your funds.

Q: What stablecoins and networks are supported by TeleSwap? A: TeleSwap supports major stablecoins like USDT and USDC, among other assets. You can swap BTC into (or from) these stablecoins on popular chains such as Ethereum mainnet, Polygon (Matic), Arbitrum, BNB Smart Chain (BSC), Base, and even The Open Network (TON). For example, you could receive USDT on Ethereum, USDC on Polygon, DAI on Arbitrum, etc. The TeleSwap documentation gives examples like buying BTC with USDC from Ethereum, or selling Bitcoin-native tokens for USDT on Polygon – showing the breadth of support. Practically, when you open the TeleSwap app, the dropdown will list which stablecoin assets and networks are available. USDT and USDC are the primary stablecoins and cover most needs. These tokens maintain a 1:1 peg to USD, so regardless of which you choose, you’re getting roughly equivalent USD value for your BTC. In short, TeleSwap covers the top stablecoins and chains, ensuring you have plenty of options.

Q: Do I need a special wallet or setup to use TeleSwap? A: No special wallet is required – just your regular crypto wallets. TeleSwap itself is not a wallet or exchange that holds funds; it’s a protocol that connects your wallets on different networks. You will need a Bitcoin wallet (for the BTC side) and an Ethereum-compatible wallet (for the stablecoin side). Many users might already have these. For instance, you might use MetaMask for Ethereum/Polygon/Arbitrum and Electrum or Xverse for Bitcoin – those will work perfectly. In the swap process, you don’t even connect your Bitcoin wallet to the site; you only need to provide a Bitcoin address or send from your BTC wallet manually. Meanwhile, your Ethereum wallet (like MetaMask) does connect to the TeleSwap app just to facilitate receiving tokens and signing any necessary approval if you were swapping the other way. In essence, “Is TeleSwap a wallet?” No – **“It’s a protocol. You only need your wallet and a Bitcoin address to use it.”* There’s no custody by TeleSwap. So use whatever self-custody wallets you’re comfortable with. If you plan to do the whole process on mobile, you might use a mobile Bitcoin wallet and WalletConnect/MetaMask Mobile for the dApp part – TeleSwap is compatible with mobile wallets like MetaMask and Xverse as well.

Q: How long do swaps take on TeleSwap? A: Most swaps are completed in just a few minutes. The exact time depends on the block confirmation times of the source and destination chains. If you’re swapping from Bitcoin to an EVM chain (BTC → stablecoin), the main wait is for Bitcoin confirmations – TeleSwap usually waits for 2 confirmations (~20 minutes) to ensure the BTC transaction is secure. After that, the release of stablecoins on the other side is almost instant (within one block on the destination chain, maybe a minute or less). So BTC→Stable might take around 20 minutes on average. If you’re swapping from an EVM chain to Bitcoin (say USDT → BTC), then you wait for the EVM transaction confirmation (a minute or two) and then TeleSwap will send BTC to you (which then needs ~1 confirmation, ~10 minutes). So that also ends up around 10-15 minutes. In many cases, the overall wait is under 5 minutes for common scenarios, especially if one side of the swap is on a fast chain. Compared to the potential hours of messing around with exchanges, this is quite fast. TeleSwap also handles all tasks automatically once you’ve sent your transaction, so there’s no additional action needed during the wait. You can just watch the progress bar and shortly see your new funds arrive.

Q: What are the fees for swapping BTC to stablecoins on TeleSwap? A: The costs involved are relatively low and transparent. TeleSwap charges two types of fees as described in their docs: a network fee and a locker fee. The network fee covers the blockchain transaction costs to deliver your funds on the destination chain. For example, if you’re bridging to Ethereum, it covers the gas to send you tokens on Ethereum. TeleSwap simplifies this by charging you that fee in the source asset, so you don’t need to have ETH for gas – if you’re sending BTC, a small extra BTC is taken to pay for the Ethereum gas on your behalf The locker fee is a small percentage (around 0.1% of the swap amount) that goes to the node operators who facilitate the swap (the “lockers”). This is like a service fee for the decentralized network. There are no other hidden fees. So if you swap 1 BTC, for example, 0.1% (0.001 BTC) might go as the fee, plus whatever the miner/gas fees are. In many cases this is cheaper than using an exchange, which might charge 0.2% trade fee plus high withdrawal fees. TeleSwap’s fees are also independent of the amount for the network part – a larger swap doesn’t necessarily pay more in network fee if the blockchain cost is the same. Overall, you’ll often save money using TeleSwap versus the traditional route. And because there’s no conversion through fiat, there are no extra spreads or bank charges.

Q: What if I make a mistake, like entering the wrong address or amount? A: When using decentralized tools, it’s important to be careful because transactions are typically irreversible. If you enter a wrong receiving address on TeleSwap (say you typo your Ethereum address for receiving USDC), the system cannot know or correct that – it will send to whatever address you provided, even if it’s wrong. Always double-check addresses you input: for Bitcoin, copy-paste the address from TeleSwap to your wallet carefully; for receiving address (if manually entered), triple-check every character. If you send a different BTC amount than intended, the smart contract might not execute the swap automatically (it expects the exact amount). In many cases, if the amount doesn’t match, the swap might fail to complete and you’d need to contact support with proof to recover funds – which can be complex. So follow the instructions precisely. The interface usually prevents some errors by calculating things for you, but user diligence is the best safeguard. If everything is correct, TeleSwap will do the rest flawlessly. In short, mistakes can be costly, so act cautiously as you would with any crypto transaction.

Q: Are there any limits or restrictions on TeleSwap (like KYC, region, amount limits)? A: No – TeleSwap doesn’t impose traditional exchange-style restrictions. There is no KYC or account limit at all. You can use it from anywhere in the world; the protocol does not geoblock or blacklist users (it’s just interacting with blockchain transactions). As for amount limits, there isn’t a fixed account tier or anything, but practical limits might exist based on liquidity. Very large swaps could be subject to slippage (if you try to swap an enormous amount of BTC at once, the available stablecoin liquidity on the other side might not give you a great price). TeleSwap likely has pools with substantial liquidity for BTC, but if you plan to swap a huge sum, you might do it in batches to get a consistent rate. Also, extremely tiny amounts might not work well because network fees could eat up too much. Generally, however, typical trade sizes from, say, $50 worth up to many thousands of dollars should execute without issue. Always check the minimum received amount that TeleSwap quotes before confirming the swap – that will show if any slippage or fee impact is significant. In essence, TeleSwap itself doesn’t set user limits; you’re only bounded by network conditions.

Final Thoughts

Swapping Bitcoin to stablecoins no longer needs to involve centralized exchanges, waiting for approvals, or compromising your privacy. Thanks to solutions like TeleSwap, decentralized crypto swaps have become a reality – you can convert BTC to USDT/USDC (or vice versa) quickly, securely, and without ever handing over your identity. This empowerment of the user is a huge leap forward for the crypto ecosystem. You get to stay true to the spirit of cryptocurrency: trusting math and code over middlemen, and retaining control of your own assets.

For beginners, TeleSwap provides a gentle entry into the world of cross-chain DeFi – the interface is simple and you don’t need advanced knowledge to use it. For more experienced users, it offers a relief from the pain points of CEXs and a way to streamline your crypto finances (for example, moving funds from a DeFi protocol on Ethereum directly into Bitcoin, or vice versa, in one step). In both cases, you gain privacy (no KYC), convenience (one-click swap), and security (no custodial risk).

As always, do your own research and maybe test with a small amount first to get comfortable. But given the robust design of TeleSwap, you might find it becoming your go-to method for Bitcoin stablecoin swaps. The landscape of no-KYC trading is growing – with TeleSwap and similar trustless bridges, we are getting closer to a world where you truly don’t have to rely on centralized entities to manage your crypto value.

In summary: How to swap Bitcoin to stablecoins without KYC? – Use a decentralized solution like TeleSwap. It’s the “ultimate Bitcoin bridge” that makes moving between BTC and stablecoins safe, fast, and private. Embrace the new era of swapping on your terms, and enjoy the freedom of staying in control of your crypto journey.